Lessons learned from analysing Value Systems from 500 asset managers worldwide.

Would you be impressed by a doctor telling you that he is professional, focused on you, that he will cure you with integrity and that you should trust him? Probably not. These are what we call ‘hygiene’ factors. Differentiation works on an entirely separate level. Yet our review of more than 1,000 values contained within the analysis of over 500 asset managers worldwide shows that this is exactly the way many companies in this space portray themselves. They focus on the obvious and consequently end up with an ill-defined and undifferentiated persona. We believe this is an aspect asset managers should focus on in an industry which is ever more competitive, and in which we see ever more evidence that cultural affinity between the client and the provider is a critical decision factor.

In this paper, we first review the results of the Value System analysis we have undertaken, before outlining some practical recommendations for asset managers interested in improving their approach to creating a stronger Value System.

A ‘Value System’ is a coherent set of beliefs and attitudes that influence every part of who we are and how we behave. Values are the deepest parts of what makes us human, governing how we see the world around us and respond to it. Values help us decide what is right and wrong, good and bad, normal or weird. And they often work at a subconscious level. Values help us form a considered opinion when we meet a new person, and they inform our major life decisions such as whom to marry, how to handle death and what makes us happy.

What applies to individuals affects commercial organisations even more so. The very reason companies spend time thinking and articulating their Value System is rooted in the necessity of describing who they are, so that they can build a cultural alignment internally and externally, hire the right talent and create relevancy for their clients.

Banality and truism prevail

As part of the research we conduct for our Responsible Investment Brand Index (RIBITM), we have analysed the Values Systems of all eligible asset managers worldwide within the Investment and Pensions Europe (IPE) Top-500 ranking.

In a world where integrity and trust are expected as a given, it comes as a bit of a shock that only half of the companies analysed articulate a Value System. Or, as Jack Welch, Chairman of General Electric from 1981 to 2001, put it, ‘Control your own destiny or someone else will.’

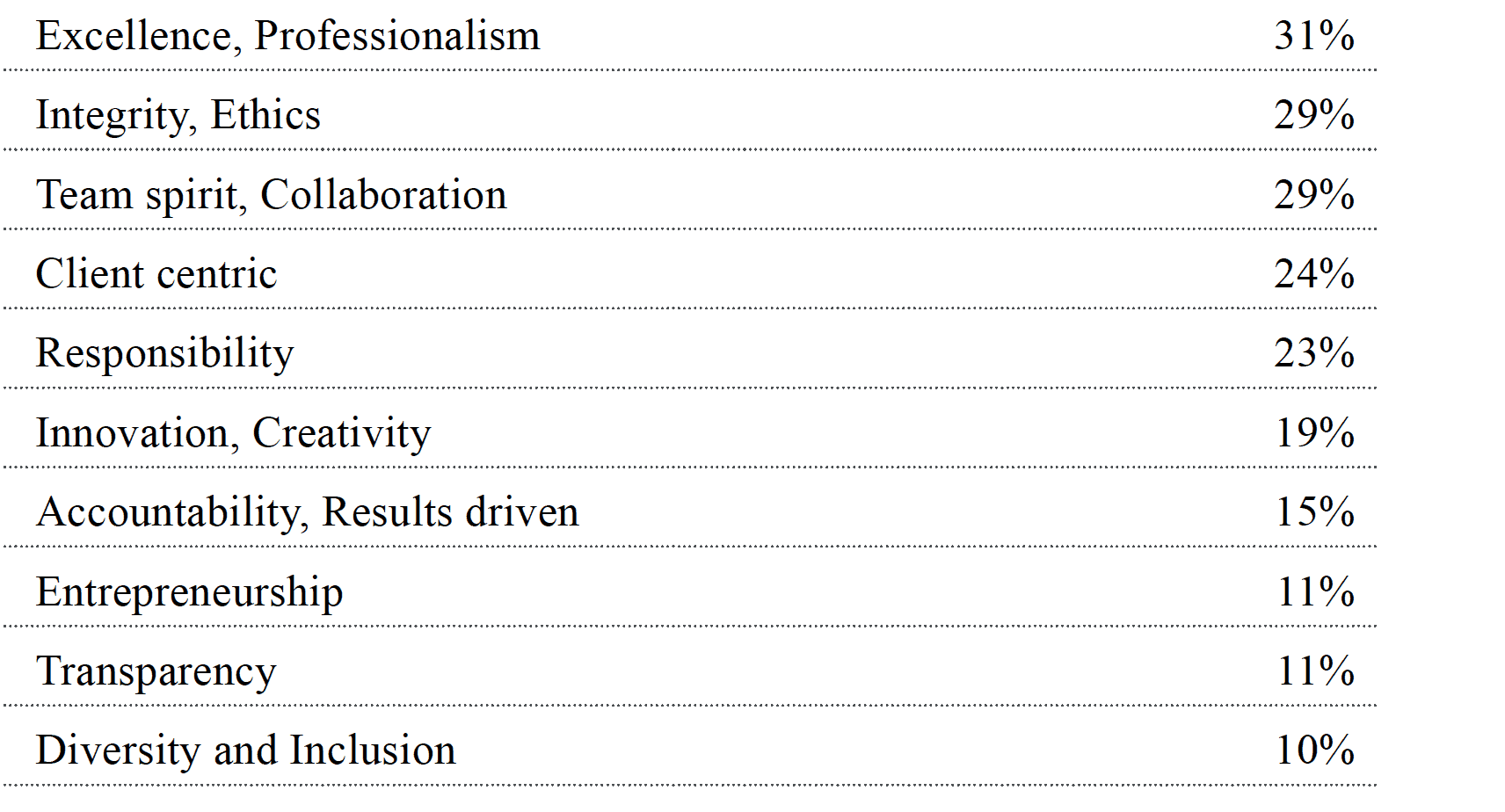

Focusing on the asset managers who proactively communicate their Value System, we found the following to be the most featured values:

Analysing for cross-regional and cultural variations resulted in only negligible differences. Clearly, active thinking and the systematic embedding of a Value System is a universal way of creating the connective tissue that makes up corporate culture. We also didn’t detect significant changes when comparing variations in Value Systems over time, meaning Value Systems seem built to last, offering an anchor of stability for all stakeholders, inside and outside the organisation.

Similarly, we also probed whether the size of assets under management makes for any tilt in how companies express their values. Specifically, we also looked at boutique asset managers (i.e. companies with less than US$20bn of AUM, who represent 35% of the firms in our sample) – we didn’t find any significant specificity across this dimension, either.

So, alas, and independent of size or geography, the Value Systems of asset managers can be summarised as follows:

We believe this is a real issue for an industry which is hugely competitive (13,000 asset managers worldwide are competing to get business from the same buyer pool) and in which alignment of values will become ever more a factor in a client’s selection process. For example, 77% of people wouldn’t invest against their beliefs. Including culture as part of selecting an asset manager is now becoming standard practice in the due diligence process of major investment consultants.

Drawing on our analysis, we offer below some recommendations to those asset managers who want to work on their Values. These recommendations are based on our academic work on brand, on the good practices we observe in successful companies in sectors where the brand is a more embedded feature, and on the work we do daily with our clients.

Top-10 tips to create a genuine, differentiated Value System

1. Stay focused

In the sample we have analysed, the average number of values expressed by asset managers is 3.5, with some managers displaying up to eight values. We recommend staying focused on a few values, ideally three, maximum four. Any more and you risk becoming ‘all things to all people’–the exact opposite of the objective. Should you come up with more, reconsider. It’s highly likely that by reviewing this further you discover there are overlaps. Think about what is hygiene, what is obvious, what can be eliminated. What truly fits? What makes you stand out from the crowd? Do your values reflect your ambitions and future vision?

2. Consider your Values as one System

Your Values together make you who you are. So, before revealing your Value System to the world, do a thorough check that everything fits together and is an accurate reflection of your company. Values complement each other and should together result in something stronger than the sum of their parts. Finally – make sure no values contradict each other.

3. Actively look for differentiation

Within your maximum three or four Values, at least one of them must be a clear differentiator for your firm. Something you are known for, something the market recognises you for. The others might be just hygiene, and that may well be right. We call these ‘behavioural Values’, traits that shape your corporate personality and character. If your Values are all part of the top 10 and your script sounds like ‘we strive for excellence, we work as a team and client satisfaction is top of mind’, you will miss the opportunity to differentiate and will likely remain unnoticed as a result.

4. Think carefully about your target audience

Every company, like every individual, is unique: a company is the sum of its history, environment and culture. Therefore, you, as a company, can make a strong and successful connection with your various audiences: clients, prospects, candidates, business partners, acquisition targets, etc. You need to define carefully who they are, and your Value System should resonate with them. It’s all about clarity and relevance.

Take ‘Innovation’ (the sixth most often displayed Value in our assessment) for instance. This value might be perfectly appealing to some audiences, while for others who are keen on protecting their wealth, it might not. We are not saying stay away from polarising Values, on the contrary. But you need to know your target audience to find the right fit.

5. Avoid what your stakeholders consider as a given

It is puzzling to see ‘Professionalism’ and ʻEthics’ coming top as the most featured Values in our analysis. For an industry at the lever of trillions of assets to manage and with a huge societal responsibility, isn’t this stating the obvious? So, we recommend staying, as much as possible, away from such truisms. Your audiences will consider these as a given and stating these so explicitly might trigger the opposite effect.

6. Values are part of something bigger

As mentioned above in tip 4, upstream you need to think carefully about your target audience. Upstream as well, you need to consider how your Value System forms part of your brand and see that it connects with other elements of your business in a consistent and seamless way. For example, a strong fit and alignment with your Purpose and your Vision is essential. Downstream you need to have a strategy on how you will activate your Value System. How are you making sure that your Values come through in all your communications, and in all your interactions with your various stakeholders? And most important of all: how are you making sure that that your employees live and breathe your Values?

7. Values are not features

A ‘Value System’ is a coherent set of beliefs and attitudes that influence every part of who we are and how we behave. Terms such as ‘Research’, ‘Performance’, ‘Work life balance’ are deliverables or characteristics – but they are not values. Asset managers using such terms miss the opportunity to touch the emotional side of the reader. In the same spirit, and while well intended, ‘Diversity’ and ‘Inclusion’ are not values as such, but often organisational design features. Sometimes, and depending on the market the asset manager works in, these elements can even be compulsory / regulated.

8. Take time to articulate your values

At the end of the demanding exercise to identify your company’s Values it might be tempting, for the sake of speed, to just use the first words that come to mind to express your newly minted Values. Please don’t. Rather, take time to reflect and discuss how best to express your Values. For example, isn’t “Challenge the status quo” more specific and eye-catching than “We are different” or “We encourage independent thinking”? Isn’t “We believe in each other”, more inspiring and much broader than “We work as a team”? Taking this time to craft your wording will make you even more distinctive, will allow you to be understood without ambiguity, and to reach the emotion of your audience. Often words are not enough. Consider searching for the right visuals and imagery to amplify and give meaning to your Values. This is an entire topic in itself.

9. Futureproof your Values

Our analysis shows that once a Value System is in place, it changes very little over time. Indeed, often when we work on Value Systems, it is about evolution, not revolution. Value Systems can provide a solid anchor of stability and especially when times get tough, can serve as a guiding north star. However, when thinking of introducing a Value System or evolving an existing one, we highly recommend contrasting this against your ambitions, your vision and required adjustment to strategy. Will your Value System hold up against this, and will it be able to act as a positive catalyst to enable change that allows you to get where you want to go? We call this part of the process ‘Futuring Values”. It is an essential way of making sure that you design a Values System that is thought through as much as possible with the future in mind.

10. Action your Values

This is perhaps the most important advice of all: lift your values out of PowerPoint, documents and websites and make sure they are alive. Include your Value System in your recruitment process so that you attract and hire talent that is a cultural fit, use your Values as part of your performance evaluations – in HR as much as in business decisions. Have your Values made visible inside your office, re-enforce them regularly within your organisation and include ‘taking the pulse” points in your employee and client engagements. And if you are fully consistent: make sure your Board holds your management team fully accountable through the lens of your Value System, too.

Conclusion

Clarity and differentiation in terms of positioning, retention and attraction in terms of making sure the right clients and talent are acquired and retained. Well-designed Value Systems are powerful beyond the impact they have on the connective tissue that shapes culture and makes you truly you. As a force that is part of something larger, your brand and your business, Values gravitate around your raison d’être (e.g. your Purpose) and fuel your vision, your strategy, and your objectives. They can indirectly contribute to operational efficiency, overcome obstacles, align tactical actions – and they can be fun to work with, too!

By pushing the right levers, a Value System requires a willingness to evolve and soundness in methodology. Or perhaps better put in the words of the Dalai Lama: “Open your arms to change but don’t let go of your values.”

This blogpost is also available as a white paper in PDF format, which you can find by following this link.